DIFFERENT LEGISLATIONS REGARDING OPAs

DARCY FUENZALIDA1, MAURICIO NASH1

1Universidad Técnica Federico Santamaría, Departamento de Industrias, Valparaíso-Chile

Fecha de recepción: 13-1-2004 Fecha de aceptación: 31-5-2004

ABSTRACT

An analysis was made of then effect of the Tender Offer Law in Chile, and of the related situation of five countries with a more developed market than the Chilean one, reaching the conclusion that in order to successfully implement a Tender Offer Law it is necessary to bear in mind that the problem is not solved by establishing standards that regulate transactions, but by creating instances that contribute to a more dynamic and efficient market. In addition, there should exist a balance between protection of the minority stockholder and competition for corporate control.

Finally, we can conclude that there is evidence that the Tender Offer Law has depressed the Stock Exchange.

KEYWORDS

Tender Offer, Tender Offer Law and Tender Offer System Law.

Classification: A

JEL classification: G34

INTRODUCTION

After 1995, foreign investors have carried out transactions in the Chilean market in order to acquire control over important local companies, thus generating a large amount of Tender Offers (IPOs). The legislation prior to Law 19,705 of December 20th 2000, that regulated the Stock Exchange were the Market and Securities Law (18,045) and the Stock Company Law (18,046), which contained scarce juridical rulings regarding Tender Offers. We will refer to different events occurred in Chile, such as A) the take-over of the Chispas stock (that grouped Almendro,Luz, Chispa Uno,Chispa Dos, Luz y Fuerza stock) by Endesa España, B) the sale of Terra, CTC Chile´s Internet subsidiary to Telefónica España,and C) the case of Campos Chilenos. We are also going to refer to important international studies such as the Zingales and Laporte report. All the above generated the need to establish a legislative framework for regulating Tender

Offers.

The objective of this piece of research is to analyse the Tender offer Law in Chile in order to reply to the following queries: What is the effect of the Tender Offer Law on the Chilean Stock Exchange? What effect does the Tender Offer Law have on minority stockholders? What is its effect on the dynamics and efficiency of the market? and What is the effect of the Tender Offer Law on stock turnover? This paper is divided into seven sections. Section I contains the methodology applied in the study. Section II will analyse Tender Offer laws in countries with more developed markets than ours. Section III will explain the reasons for the need to legislate on the subject in Chile. Section IV will analyse the Tender Offer legislation in Chile. Section V will refer to the Chilean Stock Exchange. Section Vi will show the effects of the Tender Offer Law on the Chilean Stock Exchange, and finally, Section VII contains our conclusions on the subject.Section I. Methodology Applied

In order to be able to analyse the Tender Offer Law in a country in which Tender Offers started in 1995, and which were finally subjected to legislative order on 20/12/2000, it is fundamental to understand and compare the systems applied in countries with markets that are more developed than our own. Five countries were chosen. France and Spain that have highly regulated systems and on the other hand, the United States and the United Kingdom, that have more liberal legislations on the matter. We will also analyse Germany, in its capacity as a deregulated country. We will also analyse the markets, because an adequate analysis of different legislations requires an awareness of the fact that each system must be designed according to the requirements of the financial and capital market it will regulate.

The common and most significant parameters were established In order to analyse the four regulated countries are A) Origin of the Legislation, B) Market History, C) Triggers for announcing a Tender Offer, D) Obligatory Offer, E) Information to be provided, F) Duration of anOffer, G) Partial Offers, H) Withdrawal Rights, I) Price, J) Squeeze Out,1 and K) Conclusions.

The principal hypothesis in this study is:

1. The Chilean Tender Offer Law has depressed the Chilean Stock Exchange.

The secondary hypotheses are:

1. The Chilean Tender Offer Law has triggered the closure of corporations, and very few openings of new companies in the Stock Exchange.

2. The Chilean Tender Offer Law has triggered a decrease of stock turnover2 in Chile.

Section II. International Legislations

In order to adequately understand the motivations and the need to regulate Public Tender Offers, it is necessary to understand how these transactions are regulated in countries with more developed markets than our own, and compare them with what the situation in Chile.

There are highly regulated and lesser regulated systems in the world. We will analyse different systems, principally those applied in countries like the USA, the UK, France and Spain.

On the other hand, we will analyse the situation in Germany, a deregulated country, but one that has extremely high standards of Corporate Governance.

An adequate analysis of the different legilsations involved, requires an awareness of the fact that each system must be designed according to the requirements of the financial and capital markets it will regulate. We must be aware of certain factors, such as concentration of ownership and the benefits provided by control.

The obligatory and total system has the disadvantage of making acquisition costs considerably higher, as the tender offer always involves an offer to acquire 100% of the equity stock, which discourages the corporate control market, reducing the level of demand. In spite of the reduction of demand generated by this system, it has the advantage of permitting that economically efficient administrators are the only operators allowed to launch Tender Offers. On the other hand, obligatory and total Tender Offers tend to avoid those acquisitions that are aimed at generating profits by exploiting minority stockholders.

Two examples are mentioned; the British System and the French System, which have the following characteristics:

1.1 The British System:4,5 The system that regulates Tender Offers has the following characteristics:

A) Origin of the legislation: The system is regulated by the 1985 Companies Act and by the City Code on Takeover and Mergers, issued by the Panel on Takeover and Mergers.

B) Market History: The British securities market is very liquid, and company ownership structures tend to be dispersed,6 although not as much as the US markets. The markets are extremely liquid.

C) Triggers for Informing a Tender Offer.

I) On acquiring a percentage of over 3% of the equity capital of a company

II) Any variation over 1% of the stock, after having acquired 3 or more per cent of the company.

D) Obligatory Offer: The obligatory offer is established in The City Code Rule 9.1, which states the following for an obligatory offer:

I) When 30% or more of the corporate votes are reached.

II) When a stockholder owns at least 30% but less than 50% of the stock, he/she should announce a Tender Offer every time his/her participation increases by 1% over a 12-month period.

E) Information to be provided: In the British System, a Tender Offer must provide the following information: Name of the acquirer, Name of the Target Company, Number of shares or percentage of shares to be acquired. In addition, an affidavit stating the invalidity of the offer if the total stoc that accepted the tender offer is less than 1% of the votes in the company, The offerer can establish a minimum number of shares to accept the offer, the participation of the offerer in the corporation and the period during which the offer will be in effect.

F) Duration of the Offer: The offer must have a duration of at least 21 days, and in those cases in which the offer is modified, it should be extended for at least 14 days. In the case that the stock obtained is less than 50% of the target company´s voting stock, 60 days from the opening of the offer, the offer will expire and will not be able to be renewed before a year has elapsed.

G) Partial Offers: The entire offer must cover the totality of the remaining shares. Partial Tender Offers will only be accepted with the consent of the Panel on Takeover and Mergers.

H) Right to Withdraw: Up to 21 days after the closing of the offer.

I) Price: Cannot be lower than the price paid by the offerer for target company shares in the preceding three months. If offerer acquired over 10% of the voting stock in the 12 months prior to the offer, the offer should include the best price.

J) Squeeze Out: When the majority stockholder has 90% or more of the voting stock.

K) Conclusions: This system is explained by the fact that the British market is extremely reluctant to accept the existence and operation of corporations with a controlling stockholder. This is based on the fact that once control has been gained, there is a non-liquidity problem in the target company shares, which might damage the position of the stockholders who are unable to sell. The establishment of the obligation to launch total Tender Offers, gives all stockholders the possibility to disinvest without having to apportion.7 Another explanation of this regulation lies in the fact that the British market has the largest amount of mergers and takeovers in the European scene, and that it is relatively dispersed and liquid, which has allowed the current system to succeed in spite of the kind of regulation applied.

France is another country that has chosen this system.8 The French copied the British system in the sense of establishing obligatory Tender Offers, but the rule had another justification. It was based on the principle of equal treatment among stockholders, in the sense that the premium paid by the acquirer should be proportionally distributed among all of the stockholders.9

1.2 The French System: The system that regulates Tender Offers has the following features:

A) Origin of the legislation: The system is ruled by Law Nº 351 of August 2nd 1989, by the regulations of the Securities Exchange and by the regulations of the Stock Exchange Operations Commission.

B) Market History: The French securities market seems to be more similar to the Chilean market, 10 where there are few participants. Concentrated ownership structure.

The French market is highly regulated, and with an active participation of state organisations.

C) Triggers for Announcing a Tender Offer:

I) The legislation Establishes the obligation of informing of stock acquisition when these purchases are in excess of 5%, 10%, 20%, 33%, 50% or 75% of the stock of a company that trades its shares in the stock exchange.

II) In the case of acquisitions of more than 5% of the capital stock, a statement must be issued giving the acquirer´s objectives over the next 12 months.

D) Obligatory Offer: In the case that an acquisition involves over 33.3% of a company´s stock, the Tender Offer must be made for the total stock.

E) Information to be provided: The report must include information on the acquirer´s intention of continuing to acquire company stock, on acquirer´s intention of gaining control over the company, and of acquirers´ desire to be appointed members of the administration board, board of directors or Inspection Board.

F) Duration of an Offer: Minimum 25 days, maximum 35 days.

G) Partial Offers: Obligatory and voluntary tender offers must be made for the totality of the company shares.

H) Right to Withdraw: During the effective period of the Tender Offer.

I) Price: When companycontrol is the aim, the offerer is obliged to acquire all the shares at the same price as the price offered by the controlling block.

J) Squeeze Out: The owners of 95% of the company stock are allowed to acquire the totality of the stock. The price will be established by independent qualified accountants.

K) Conclusions: Owing to its high degree of regulation, the French system has made takeover transactions more expensive. Concentrated ownership structures sill predominate in France, and this has resulted in a less liquid market than the US or UK markets.

This system on its own does not protect minority stockholders11 from the possibility of cost externalisation. When target company stockholders are unable to sell the totality of their stock, given the apportionment system, they are forced to remain as minority stockholders, losing share liquidity and running the risk of being exploited by the controllers.

We will now look at the Spanish system, which has the following features:

2.1 Spanish System12 The system that regulates Tender Offers has the following characteristics.

A) Origin of the Legislation: Tender Offers for share acquisition and sale are regulated by Law Nº 24 of the Securities Market and by the regulations of the Stock Exchange Operations Commission.

B) Market History: The market has a more concentrated ownership than that of the US and UK.

C) Triggers to Announce a Tender Offer: The petition to announce a Tender Offer is presented in an explicative document submitted to the national securities market commission.

D) Obligatory Tender Offer:

I) If, on acquiring or recovering over 50% of the voting stock of a company, the acquirer wishes to change the company bylaws, the acquirer should previously announce a Tender Offer to the company´s remaining voting stockholders.

II) When the aim is to acquire 25% or more of the company´s equity stock, the offer should be made for the number of shares that represent a minimum of 10% of the capital of the affected company.

III)When the acquirer has over 25% but under 50% of the company´s equity capital, and wishes to increase that participation in at least 6% over a period of 12 months, the offer should be made for shares that represent at least 10% of the capital of the affected company.

IV)When the aim is to reach a participation of 50% or more of the company´s equity capital, the offer should be made for a number of shares that will enable the acquirer to obtain at least 75% of the capital of the affected company.

V) If the share participation of a given stockholder exceeds the participation percentages established in II), III) and IV), the partner involved cannot acquire more shares than those specified in those items.

VI)When a corporation goes from open to closed, and the Securities Market Commission considers that the minoirty stockholders were harmed, the corporation is obliged to make a Tender Offer to all the stockholders that did not approve the closure of the corporation.

E) Information to be provided: When a Tender Offer is required, the Spanish system requires the submission of an explicative brochure which gives a detailed description of the operation planned.

F) Duration of an Offer: The period of acceptance will be established by the offerer, and will be no shorter than a month or longer than two months. The offer may be extended with the authorisation of the Securities Market Commission.

G) Partial Offers: Partial Offers are allowed.

H) Right to Withdraw: Once the offer has been accepted, there is no possibility of refusing it. The only possibility to recant would be the existence of a new competing Tender Offer with better conditions.

I) Price: The price of the offer cannot be lower to the teoretical book value of the corporation, to its liquid value, or to the mean market value of its shares during the six months prior to the application for exclusion, regardless of the number of sessions the trading required. The previous counter-offer price (in the understanding that there had been a tender offer over the past year), is valid as from the date of the agreement of application for exclusion.

J) Squeeze Out: Not contemplated.

K) Conclusions: This system does not on its own protect minority stockholders from cost externalisation. When target company stockholders are unable to sell the totality of their stock, given the apportionment system, they are forced to remain as minority stockholders, losing share liquidity and running the risk of being exploited by the controllers.

Nonetheless, the Spanish legislation contains various cases in which a Tender Offer is obligatory.

As opposed to the other systems, in the case of wishing to acquire a determined level of stock participation, (voluntary Tender Offers),13 this system does not establish minimum percentages to be acquired.

An example of this is the US system.

3.1 The US System:14 Before 1968, Tender Offers were ruled by the Securities Exchange Act and were not regulated. During this period, a common tactic to acquire companies was to announce an offer in the Wall Street Journal, specifying nothing but the percentage the acquirer wished to purchase and the price offered.

The Williams Act was approved in 1968, and added sections 13 (d)-(e) and 14 (d)-(e) and (f) to the 1934 Securities Exchange Act.15

The system that regulates US Tender Offers has the following features:

A) Origins of the Legislation: At a federal level, it is regulated by the Williams Act of 1968, which modified the 1934 Securities Exchange Act, incorporating sections 13(d)-(e) and 14(d)-(e) and (f).

B) Market History: This is the largest market in the world for Tender Offer operations. The main factors that explain this are a capital market with a very dispersed stock ownership, high liquidity levels and important secondary markets.

Detailed and exhaustive regulation

C) Triggers for announcing a Tender Offer.

I) When over 5% of any kind of share is purchased from an open corporation, the Securities and Exchange Commission (SEC) should be informed of this operation. This information should also reach the relevant stock exchanges and the issuers of the stock, within a period of ten days following the operation.

II) When a person who owns 5% or over of a company´s capital stock acquires more than 2% of the stock over a period of less than 12 months.

D) Obligatory Offer: No obligation of this kind exists under any type of circumstance.

E) Information to be provided: The following information should be provided: Exact number of shares acquired, identification of acquirer, his/her commercial data and information regarding criminal causes. In addition, the origin of the funds used in the acquisition. Detail of loans contracted and any other contract related to the acquisition. Number of shares held. Detailed description of the purpose of the acquirer on purchasing the shares, including plans regarding an eventual control operation, mergers or sale of a large part of the assets of the corporation. An affidavit should also be issued if the acquisition was made for exclusive investment purposes, and a detailed report regarding the relationship existing between the acquirer and the target company.

F) Duration of an Offer: The minimum period is 25 days and the maximum period, 35 days.

G) Partial Offers: Partial offers are allowed.

H) Right to Withdrawal: During the effective period of the Tender Offer.

I) Price: If, during the effective period of the offer, the offerer increases the price he/she is willing to pay, he/she should pay this new price to all the stockholders that accepted the offer.

J) Squeeze Out: Within the state regulations, most states allow the possibility of a squeeze out. In Delaware, in the case that a majority stockholder has over 85% of the corporate shares, he/she has thefaculty to oblige the remaining stockholders to sell their stocks to the majority stockholder. This is a squeeze out, and to fix sale price, minority stockholders may resort to valuations.

K) Conclusions: At first sight, this system would appear to contribute to the exploitation of minority stockholders, in the sense that it allows the purchase of the minimum participation required to reach corporate control, because - in spite of the apportionment system- a large percentage of stockholders are forced to remain in the corporation as minority holders.

But, regardless of its formal characteristics, this system has shown that it works well.

This is based on the high level of control applied on those corporations that operate in the US stock exchanges, via the SEC,16 which reduces the possibility of abuse on the part of controlling holders. On the other hand, the characteristics of the US securities markets have contributed to protect minority stockholders. These markets are highly developed and liquid, and include the operations of corporations with property schemes that are generally dispersed, which has generated a corporate control market that is both active and efficient.

Finally, it is necessary to mention that a voluntary Tender Offer system, such as the one that exists in the U.S.A to protect minority stockholders, is practically unfeasible in countries that do not have structural characteristics that are similar to those that exist in this market.

Countries such as Germany have opted for a non regulated Tender Offer system, but in order to compensate for this, they have established high standards of corporate governance in order to avoid possible abuse on the part of controlling holders.

Germany chose an alternative system for protecting the interests of minority stockholders, based on a severe regulation of corporate governments, which tends to reduce the probability of exploitation. These regulations are based on the assumption that acquirers will manage the acquired corporation in their own benefit, which will have a patrimonial effect on minority stockholders. This has led to the establishment of different protection standards such as a system that compensates minority stockholders that decide to remain in the corporation or to indemnify them in cash or in stocks or certificates if they wish to sell their corresponding participation.

The deregulated Tender Offer system responds to the characteristics of the German securities markets, which, together with most of their European counterparts, have a high ownership concentration and are not very liquid, so that the establishment of a Tender Offer system would supposedly go against the already scarce activity presented by the corporate control market.

In spite of the above systems, the "Ubernahmekodex" or "Tender Offer Code" was approved on July 14th 1995. This Code was created by the "Boresensachvertandigenkommission", the organisation in charge of controlling the German securities markets. This code establishes the recommendations for the contents of a Tender Offer announcement, the obligation of stating that the offerer will obey the regulations established by the code, in order to fulfil his operation. This code regulates both voluntary Tender Offers, with regulations similar to those existing in the United States, and in the case of Obligatory Offers, its Section 16 establishes the obligation of announcing a total Tender Offer in the case of acquiring control of a target company. The same section states the moment in which a corporation has been controlled by an offer. We can state that this code establishes a system that is a mixture of the English and the US systems. As regards the English system, the Ubernahmekodex has not gained the required support within the German market for a simple recommendation to become support. In this sense, its use has not become generalised, so that the German Tender Offer system continues to be to a great extent deregulated.

Section III. Need to Legislate in Chile

After 1995, foreign investors have operated in Chile with the aim of gaining control over large Chilean companies. The legislation prior to Law 19,705 contained very few references regarding ender Offers or IPOs.

Different events that occurred in our stockholding operations led authorities, regulatory bodies and the Stock Exchange to address the Tender Offer issue, which lacked a legal system regarding a systematic, institutional and organic treatment of these offers.

In 1997, an event shattered public opinion, when Endesa España started to try to take over Chispas (Almendro, Luz, Chispa Uno, Chispa Dos, Lus y Fuerza) shares. In this operation, the corporate capital comprised different series of shares and when a detail of the operation was given out, information showed that a specific share series was offered a greater economic value, in addition to other benefits that were not available to other series. The following were the more polemic elements of the offer:18

I) The only stockholders that were able to take part in the Tender Offer were the stockholders of the Chispas corporations registered as at May 30th 1997, which is to say, nine weeks prior to the announcement of the purchase.

What would have been the reason to exclude from the offer those who acquired Chispas stock after that date?

II) Endesa España paid three different prices for the tender offer, establishing a difference not only according to series but also according to type of stockholder. Even though, in the latter case, they all had assets with equal rights, holders of Series B stock (ex executive) were offered 200,000 per share, which is ninety one per thousand per cent more than the price paid to general stockholders. At the same time, the latter received an average price that was 18.2% lower than that offered to workers, directors and former workers that owned this kind of stock. In this way, 37 % of the total amount that Endesa España invested in order to acquire Chispa stock, was paid to Series B stockholders, who had 0.06% of the capital stock.

The questions regarding the efficiency of local legislation to protect stockholder interests was also reinforced by the subsequent sale of assets between related parties, such as the sale of the Internet, Terra Chile affiliate, of Telefónica CTC to Telefónica España, as was the case of Campos Chilenos.

These events are explained by the fact that in those days, the legislation in force did not regulate the duration of the offer, the possibility of extension, the price to be paid, the right of the stockholders that accepted the offer to withdraw shares during the effective period of the offer and the conditions under which the offer became nil. This is explained because the laws that regulated the Stock Exchange, namely Securities and Market Law 18,045 and Closed Corporations Law 18,046 provideded very little regulation regarding this type of operations although it was finely tuned and regulated in countries such as Spain and France.

The executive provided the arguments of University of Chicago´s Professor Zingales to modify the law. Prof Zingales stated "As the control value of a company is nothing but the current value of the private benefits of the owner of the controlling stock, the difference in this magnitude depends on the degree of protection given to the minority stockholders of each country." 19

Studies carried out on the way that the legal structure of markets and the protection offered to minority stockholders affects corporate ownership structure shows the need to improve the accounting system of a company in order to give the market greater transparency and to improve the judicial system. La Porta´s20 studies analyse the laws that protect corporate stockholders, the origins of the laws and the tools existing to fulfil the regulations established in 49 countries. The result of these studies concludes that Chile has work pending regarding the efficiency of the judicial system and the laws that regulate securities transactions in the Stock Exchange. Mention is also made of the need to improve the accounting standards to be provided by the companies, and the need to professionalise in-company decision making, independently from personal relationships. In comparison with countries with similar per capita incomes, the above mentioned factors are below par. As Chile is a small country with limited resources, this differentiation needs efficiency ad transparency.

Foreign experiences and the contributions of foreign specialists lead us to conclude that the operations of the open market have been severely questioned in Chile, especially as regards the lack of protection to minority stockholders in operations that involve corporate ownership. A stockholder may obtain important benefits from corporate control operations. But the potential costs associated to a deficient legislation can be even greater.

Section IV. Chilean Tender Offer Law

1.1 The Chilean System:21 The system that regulates Chilean Tender Offers has the following characteristics.

A) Origin of the Legislation: Regulated by Law 19,705 of December 20th 2000.

B) Market History: The market has a high ownership concentration and its share turnover22 is low: 6.89%. This is equivalent to stating that in a year a mere 6.89% of the companies operating in the stock exchange change owners.

C) Triggers for Announcing a Tender Offer: When the aim is to obtain control of a corporation submitted to the control of the Superintendency.

D) Obligatory Offer: An Offer is obligatory when:

I) It enables a person to take over control of a company.

II) Every acquisition that obtains the ownership of 30% or over of the stock of a given company should be subjected to a Tender Offer.

III)When after a share acquisition, a given person controls two thirds or over two thirds of the voting stock of a company, this person is obliged to make a Tender Offer for 100% of the Company stock.

IV)When a person who aims to acquire control of a company that controls another company, and makes a Tender Offer for these shares that represents 75% or more of their consolidated assets, this person must make a tender offer to the stockholders of the latter company in accordance with the regulations established in this Section. The above, should include an amount that is not lower than the percentage that enables this person to gain control.

V) In the following 12 month period, the new controlling stockholder will only be able to acquire more than 3% of the stock by means of a Tender Offer and the price to be paid must have a minimum value equivalent to the control takeover price. But in the case that the acquisition is undertaken in a stock exchange and in apportionment operation for the rest of the stockholders, a larger percentage of the stock may be acquired without the need to submit a Tender Offer.

E) Information to be Provided: The following information should be provided: Financial, juridical and business description of the offerer. Minimum number of shares or percentage of shares required for a successful offer. Price and payment conditions. Duration of the offer. Method by which the offerer will finance the payment of the stock at the end of the offer. Finally the conditions or events that might produce the revocation of the offer and other general regulations issued by the superintentency.

F) Duration of an Offer: The duration of an offer cannot be less than 20 days or more than 30 days. An offer can be extended for a maximum period of 15 days and a minimum period of 5 days.

G) Partial Offers: Partial offers are allowed, with the possibility of apportionment, provided that the number of shares that accepted the offer is greater than the number of shares that the offerer offered to acquire.

H) Right to Withdraw: Stockholders that have relinquished their shares may totally or partially withdraw them for the duration of the offer or of its extension.

I) Price: Control Premiums are related to a price that is substantially higher than the market price, which will be fixed annually by the Superintendency of Securities and Insurance by means of a general regulation based on a percentage that cannot go below 10% or over 15% of the market price of a share. By market price we understand the average weighted share price during the 90 day Stock Exchange price prior to the Tender Offer without taking into consideration the last 30 days.

J) Squeeze Out: This is not considered.

K) Conclusions: The most important conclusions are:

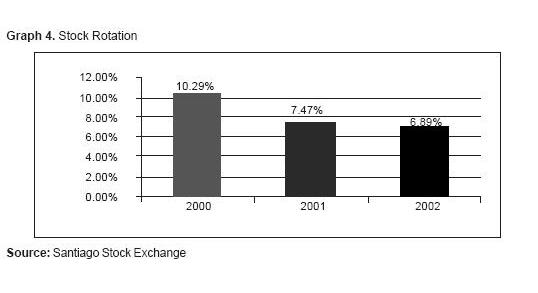

The establishment of the obligation to ake a Tender Offer for all the remaining company stock when 2/3 of ownership has been reached has the aim of giving the minority stockholder a way out when his/her titles and stocks fall because they are divergent with those of the controlling holder. It is important to bear in mind that 2/3 provides sufficient quorum to make a variety of corporate changes. On the other hand it is also true that this might be the equivalent of forcing companies out of the exchange, reducing market liquidity and reducing diversification possibilities for investors. The Tender Offer law has not made the Chilean Stock Exchange more attractive for the companies that look for financing nor for investors, as a total of 37 companies have closed between 2000 and 2002 and a single additional company has registered with the Stock Exchange.

A balanced Tender Offer law should tend to reduce conflicts of interest between minority holders and controllers, but it should also promote competition for corporate control in such a way that it works in such a way that it provides maximum benefits to all its stockholders. The Chilean Tender Offer law contains this fist element, but it tends to discourage current controllers from selling their property.

Section V. The Chilean Stock Market

In Chile there are 246 companies that operate in the Santiago Stock Exchange, of which 20 have different share series. Of these 20, 17 have dual shares, 2 have three series of shares and one has four series of shares.

The Chilean Stock Exchange has a high concentration of share ownership which increased in the 1990s- In 1990 the three major stockholders had an average of 51.19% of the ownership of companies registered in the stock exchange (the majority shareholder had 39.29%), in 1998 the three majority stockholders had 64.37% of share property, and the majority shareholder had 49.81%, in circumstances that the first shareholder to own over 50% of the stock can easily control the corporation, unless there are pre-eminent control shares or special quorum shares.

The main corporations traded in the Stock Exchange are connected to family interests or investment groups. In 1998, these economic group companies owned 76.04% of the Stock Exchange, while 62% of the corporations traded in the Stock Exchange belong to an economic group.23

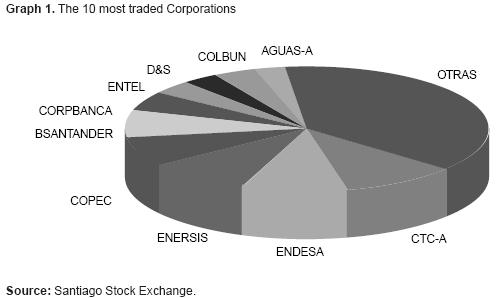

As the Chilean Stock Exchange is concentrated mainly in Chile, it is important to see the high market concentration of the ten most traded shares in Chile.

On the other hand it is also interesting to see the 10 shares that have a higher stock exchange value. The following table and graph show their evolution over the past 10 years.(See table 1 and graph 1)

In the year 2002, the 10 most traded shares corresponded to 6 sectors that had a greater trade presence. Electric Power Generation and Distribution (Colbún. Endesa and Enersis), Banks (Bansander and Corpbanca), Telecommunications (CTC-A and Entel), Forestry (Copec), retail (D&S), and Public Services (Aguas-A). It is important to point out that the 10 most traded companies correspond to 62% of the market and that 236 companies correspond to the 38% of the remaining shares. On the other hand, the 4 most traded shares correspond to 36% of the market total.

Section VI. Effect of the Tender Offer Law on the Chilean Stock Market

In 1997 there was an event that had a strong impact on Chilean public opinion, this was the fact that Endesa España was trying to control the Chispas Stock (formed by Almerndro, Luz, Chispa uno, Chispa dos, Lus y Fuerza). In that operation the capital of the target companies was made up by different share series, and when information regarding the negotiations was given out, the public was told that a series of shares was offered a higher economic value and other benefits that were not offered to the other share series. In this company there was no restriction regarding the amount of shares required to have a determined number of votes, or the reason for which Chispas, with 0.06% of the stock chose 4 of the 9 company directors. This was Endesa España´s most questioned company Tender Offer and was one of the most important triggers for creating the Tender Offer Law in Chile. Nonetheless, the only issue that was legislated vis-à-vis the dfferent share series was to restrict their duration to a period of five years, although they could be extended for a further period by an Extraordinary Stockholders´ Meeting, requiring the vote of two thirds of the total shares issued (These five years are unlimitedly renewable)- But it establishes no restriction for the share percentages required to have a determined number of votes.

The Tender Offer Bill contemplated the elimination of the possibility of issuing shares with different series, as a way of avoiding the pre-eminence of one share series over the company and of preventing the possibility that it received a larger control premium than other shares. After an analysis and review of important studies such as the Crossman and Hart paper,24 it was argued that the existence of corporations with a separation between economic and political rights does not imply the expropriation of income from minority voters. They also conclude that there is no certainty regarding the convenience of preventing share series from obtaining more efficient ownership structures. Finally, it was decided not to eliminate share series. Nonetheless, we believe that it is important to modify the Tender Offer law and to establish a restriction between the percentage of shares required to have a determined number of votes. Not to do so would give way to situations similar to the Chispas issue we have just mentioned.

On the other hand, it is important to observe that in Chile stock ownership turnover, which we call share rotation, is low,

This indicator is the result of the division between the amount traded and the stock exchange patrimony over a year.

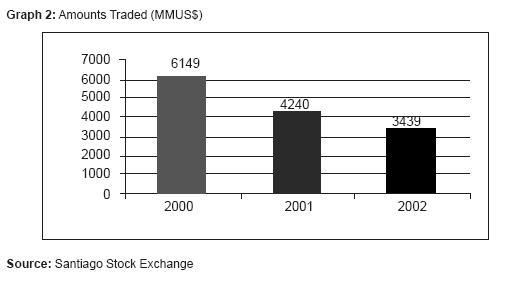

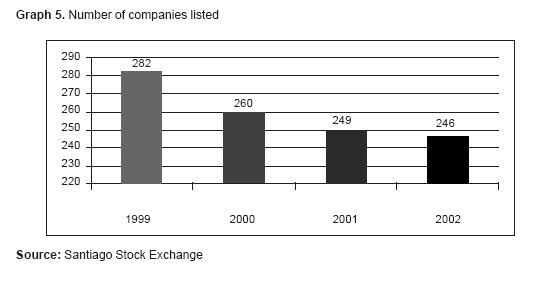

The following graphs illustrate market evolution since 2000, when the Tender Offer Law came into effect. We can see how the amounts traded and the stock exchange patrimony have fallen as a result of the fact that the Tender Offer law obliges offerers to make Tender Offers for the entire stock in a company. This is due to the fact that as 2/3 or more of the property has been acquired, it encourages a greater ownership concentration, reducing competition for control and making other companies leave the stock exchange, thus reducing competition for control.

The above has 3 negative consequences:

A) Decrease of amounts traded (See graph 2)

B) Decrease of stock exchange patrimony (See. graph 3)

C) Decrease in ownership turnover (See. graph 4).

The Tender Offer Law has not made the Chilean Stock Exchange more attractive for the companies that search for financing or for investors. Between 2000 and 2002, 37 companies have been created and a single company has registered in the Stock Exchange.

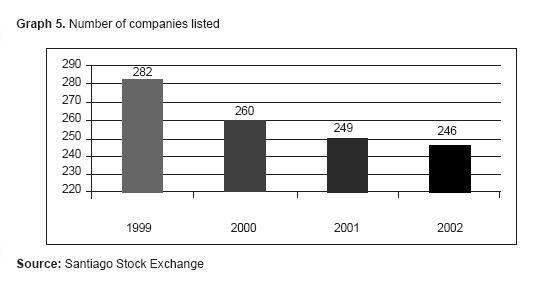

Graph 5 shows that this law has encouraged the closure of various corporations over the last few years.22 stock corporations closed in 2000, 11 did so in 2001, and 4 companies closed in 2002, with a single new company registering with the Stock Exchange. A single company has registered in the stock exchange since the year 2000 (..See graph 5)

In spite of protecting minority stockholders, the Tender Offer law in Chile has not made the Chilean Stock Exchange more attractive for companies looking for financing or investors. The creation of an efficient market should not be based on the creation of regulations that make it more rigid and less dynamic. The protection of minority stockholders can by attained by a balanced Tender Offer Law that protects minority stockholders and makes the Chilean Stock Exchange more attractive for the companies that look for financing or investors, encouraging competition for control. In order to do this, Chile requires a law that is more flexible, together with high standards in terms of Corporate Governance.25

Section VII. Conclusions

In order to understand and analyse the Chilean Tender Offer Law, it is fundamental to make an analysis of the Tender Offer legislations applied in more developed markets. Spain and France have extremely strict regulations regarding take-over and tender offers, with ownership structures that are more concentrated than those that prevail in the U.S.A. or England.

As regards the U.S.A and the United Kingdom, the most important regulatory issue to be applied is that the information gven out to the market should be as complete as possible. There is no better mechanism for solving market problems than its own specific strengths.

On the other hand, Germany has a deregulated system, with extremely high standards of Corporate Governance.

We can conclude that the legislation should bear in mind ownership structure, market efficiency, the market development of a country in which regulatory measures are established and the Corporate Governance standards of the country.

The basic problem is not solved with the establishment of standards for regulating transactions but with the establishment of paths towards a more dynamic and efficient market.

On analysing the Chilean Tender Offer Law and its effect on the Stock Exchange, a comparison between 31/ 12/2000 and 31/12/2002 has led us to identify the following effects that have occurred since the creation of the Tender Offer Law:

A) Stock exchange transactions fell from 6,149 (MMUS$) to 3,439 (MMUS$), i.e. a fall of 44%.

B) The stock exchange patrimony falls from 59,770 (MMUS$) to 49,869 (MMUS$), i.e. a fall of 17%.

On analysing stock rotation, which is amounts traded/stock patrimony, this percentage gives us the percentage of corporate stock ownership that changes owners. When comparing 31/ 12/2000 with 31/12/2002 stock turnover ranged from 10.29% to 6.89%, which represents a reduction of 33%. (In the U.S.A. stock rotation reaches approximately 90%). In Chile, it was low in 2000, with 10.29%, and with the creation of the Tender Offer Law fell to 6.89%, which is extremely low. On the other hand, since the Tender Offer Law was passed in Chile, 37 corporations have left the stock exchange, while a single new company has registered, which has resulted in a decrease of the stock exchange patrimony and a fall in stock exchange transactions.

The conclusion is that in a developing country such as Chile, the capital market requires encouragement, which is obtained with an efficient market. And an efficient market does not need standards that render it more rigid and discourage its dynamism; what it does need is the creation of institutions that flexibilise market operations and competition for corporate control. Minority stockholders can be protected with a dynamic and efficient corporate control market, with few regulations and high standards of Corporate Governance. The Chilean Tender Offer Law has made offers more expensive because it "obliges" the distribution of the controlling interest price among all the interested stockholders. This may make efficient purchasers uninterested in announcing a Tender Offer, because it is too expensive, and this obviously goes to the detriment of all stockholders.

Another conclusion is that Chile requires an efficient and dynamic market, and this calls for laws that render the market more flexible in order to stimulate a depressed market that requires more stock exchange transactions. It is also necessary to stimulate a larger number of corporations to feel attracted by the Stock Exchange and to prevent abandonment. This would increase stock exchange capitalisation and greater diversification.

The recommendation would be to modify the Tender Offer Law, eliminating the obligation of carrying out total Tender Offers, which in other countries might be positive, but which is not the case in Chile. In Chile, the regulation that forces the acquisition of 100% of a given stock package when 2/3 of the stock ownership is reached, generates clear incentives to turn an open stock company into a closed corporation, making companies abandon the stock exchange. On the other hand, even though this law protects minority stock holders, it is not encouraging competition for corporate control, and a balanced law must bear these two fact in mind. What Chile requires is more dispersed ownership and an incentive in terms of competition for control, so that there are more companies entering the market than leaving it. Chile should eliminate then obligatory nature of total Tender Offers and maintain voluntary and Partial Tender Offers. This would make the market more flexible, together with improving Corporate Governance standards, thus protecting minority stockholders and increasing the dynamism of the market.

Finally, we canconclude that there is evidence that in Chile the Tender Offer Law has depressed the Stock Exchange. Proof of this is the fact that 37 corporations have closed and a single company has joined the Stock Exchange after the law came into force. On the other hand, the reduction of the volumes trades has resulted in a reduction of stock turnover. This proves both the primary and secondary hypotheses of this paper.

REFERENCE

FOOTNOTES

1. The possibility of a stockholder who has come to own a high percentage of shares in a given company, being able to acquire the rest, at a price that is generally fixed by a qualified accountant.

2. This indicator is the result of the division between the amount traded and the stock exchange equity during a year.

3. Fernández-Armesto, Juan. op.cit. p. 45.

4. The law that regulates the British system is the "City Code on Take-overs and Mergers" .

5. Berger, Richard (1996) "A comparative Analysis of Takeover Regulation in the European Community", Harvard Press, 1996. pp. 56-62.

6. See Mayer. "Firm Control and inaugural", Said Business School, University of Oxford, February 1999.

7. Fernández-Armesto, Juan. op.cit. pp. 41 and 42.

8. Lkaw of August 2nd 1989, ruling the security and transparency of the financial market.

9. Fernández-Armesto, Juan, op. cit. p. 42.

10. LaPorta, R., Lopez de Silanes, F.A., (!999) Corporate Ownership Around the World. Journal of Finance Economics 11, pp. 471-517.

11. It requires a good parallel system of corporate governance.

12. This system is regulated by Law Nº 24 of the Securities Market and by regulations of the Stock Exchange Operations Commission.

13. Parallel to this, a good corporate governance system is required.

14. At a federal level, it is regulated by the 1968 Williams Act that modified the 1934 Securities Exchange Act, incorporating sections 13(d)-(e) and 14(d)-(e) and (f).

15. Soderquist D, Larry. Op. Cit-′- 360

16. The Securities and Exchange Commission controls and regulates US securities markets.

17. see German Aktiengesetz Regultetions.

18. Maqueira, Carlos (2000). "Evolución de la OPAS en Chile y su regulación" . Rev. Economía y Administración, número 137. Universidad de Chile,. pp. 30-38.

19. Zingales, L ("000). "Por qué vale la pena tener el control de la empresa" . Published in Nº 6 Mastering Management pp. 1-4.

20. La Porta, R, Lopez de Silanes F.A. (1999), Corporate Ownership Around the World. Journal of Financial Economics Ii, pp 472-527.

21. Regulated by Law 19.705 of December 20th 2000.

22. Value calculated with Santiago Stock Exchange - Annual Report (2002) data.

23. Majluf N., Abarca N., Rodriguez D., Fuentes L (1998)., "Governance and Ownership Structure in Chilean Economic Groups", Revista Abente Vol. 1 pp 111-139.

24. Crossman, S. and Hart, O (1988). One Share One Vote and the Market for Corporate Control. Journal of Financial Economics 20. pp. 175-200

25. Establishes in the economy the regulations and standards that will rule the behaviour of controlling stockholders, corporate directors and administrators, and defines their obligations and commitments visà- vis external investors (non controlling stockholders and creditors).

BIBLIOGRAPHY

1. Alcalde, Enrique (2001). Regulación sobre la "Venta del control en la ley de OPAS: ¿Un caso de inquietud o simplemente un error? Revista Chilena de Derecho, Vol. 28 No. 3. Sección Estudios: Pontificia Universidad Católica de Chile pp. 599- 624.

2. Berger, Richard (1996). "A comparative Analysis of Takeover Regulation in the European Community", Cambridge: Harvard Press, 1996. pp 26-62.

3. Clarke de la Cerda, Álvaro (2001). "Modernización del mercado de capitales chileno" : "La nueva ley de ofertas públicas de adquisición de acciones y gobierno corporativo" ; Revista Iberoamericana de Mercado de Valores.

4. Fernández-Armesto, Juan (1998), "Las OPAS y el mercado de control empresarial: Un balance de diez años de experiencia", Madrid, Revista de Derecho Mercantil.

5. Grossman, S & Hart, O. (1988). One Share One Vote and the Market for Corporate Control. Journal of Financial Economics 20, pp. 175-200.

6. Mayer (1999). "Firm Control, an Inaugural Lecture", Said Business School, University of Oxford, February 1999.

7. Majluf N., Abarca N., Rodriguez D., Fuentes L. (1998), "Governance and Ownership Structure in Chilean Economic Groups", Revista Abente, Vol. 1 pp. 111-139.

8. Maqueira, Carlos (2000). "Evolución de las OPAS en Chile y su Regulación", Rev. Economía y Administración, No. 137, Universidad de Chile pp. 30-38.

9. La Porta, R., Lopez de Silanes, F. A. (1999) Corporate Ownership Around the World. Journal of Financial Economics 11, pp. 471.517.

10. Llanes Ríos, Claudio (2001) "Seminario de magíster sobre Ley de OPAS" Universidad de Chile.

11. Weston, Chung. (2001). "Takeover, Restructuring and Corporate Governance", Siu, Prentice Hall.

12. Zingales L (2000). "¿Por qué vale la pena tener el control de la empresa?" Publishes in Revista Mastering Management No. 6 pp. 1-4

REGULATIONS AND OTHERS

1. Germany. Aktiengesetz. München: Autor. 22 de septiembre de 2005.

2. Spain. Spanish Securities´ Market Law. 24 July 1988. Author

3. Securities Market Law No. 18, 405.

4. Corporation Law No. 18, 046.

5. Corporate Governance System. Tender Offer Law No. 19, 705.

6. France. French Law "On financial market security and transparency". No. 89/531

7. COB (Stock Exchange Operations Commission) Regulations.

8. Britain. City Code on Takeovers and Mergers, 1 may 2002.

9. Soderquist, Larry G. (1996). Securities Regulation, New York: The Foundation Press, Inc.

10. Santiago Stock Exchange - Annual Report (2000). Santiago de Chile.

11. Santiago Stock Exchange - Annual Report (2001). Santiago de Chile.

12. Santiago Stock Exchange - Annual Report (2002). Santiago de Chile.