1. Introduction

At present, born-global (BG) firms are considered a major source of economic growth, contributing significantly to the development of many countries (Ahlstrom & Ding, 2014). They are “emerging in substantial numbers worldwide, and likely reflect an emergent paradigm, with the potential to become a leading species in the ecosystem of international trade” (Knight & Cavusgil, 2004, p.137).

Although there have been some studies on BG firms, the research literature remains underdeveloped (Knight & Liesch, 2016), and knowledge about internationalisation process (IP) development is still very limited and fragmented (Gassmann & Keupp, 2007; Melén & Nordman, 2009). Studies on how and why BGs internationalize have been requested (Perényi & Losoncz, 2018) and some authors have suggested qualitative studies to deepen research (Dzikowski, 2018; Liesch, Weerawardena, Sullivan, Knight, & Kastelle, 2007).

The relationship between strategy and structure aroused researchers’ attention early. For example, Chandler (1962) concluded that changes in corporate strategy precede and lead to changes in organisational structure. “A new strategy required a new or at least refashioned structure if the enlarged enterprise was to be operated efficiently” (Chandler, 1962, p.15). Chandler’s definition of structure has two facets; first, the lines of authority and communication between the different administrative offices and officers; and second, the information and data that flow through these lines (Chandler, 1962, p.14). As an information system, the Management Accounting and Control System (MACS) integrates organisational structures and can therefore be defined as a tool that managers use to maintain or alter patterns in organisational activities and to implement strategies (Anthony & Govindarajan, 2007). However, little is known about MACS’ effects in strategy implementation (Frigotto, Coller, & Colin, 2013; Roberts, 1990; Skaerbaek & Tryggestad, 2010).

Henri (2006) presents two distinct lines of enquiry in a study of the relationship between strategy and MACS. The first emphasises strategic effects on MACS; while the second emphasises MACS’ effects on strategy. This latter approach recognises and studies MACS’ role throughout the strategy implementation process, using a procedural and dynamic approach. This is the approach used in this paper.

Some authors (Cumming, Filatotchev, Knill, Reeb, & Senbet, 2017; Ismail, 2013; Lin, Chen & Lin, 2017; Puck & Filatotchev, 2018; Roque, Alves, & Raposo, 2019b, 2019c; Tessier & Otley, 2012) have encouraged further study which might aim to understand how MACS can assist firms in strategy implementation. Therefore, this paper presents two questions: (1) how does a company’s MACS facilitate (or not) the implementation of a born-global internationalisation model (BGIM); and (2) how has the BGIM implementation involved (or not) changes in the MACS (and, if so, which?). In order to answer these questions, a qualitative research study was developed based on the case study process proposed by Yin (2009, 2014) through an exploratory single-case study in a Portuguese firm in the technology sector.

Data were collected from key informant through in-depth interviews. The preparation of the interview script allowed us to collect more detailed and more promising information (Dana & Dummez, 2015; Yin, 2009, 2014) for document analysis.

The case study combines data from different sources, such as in-depth interviews and documents, completed by site visits to generate construct validity and reliability (Eisenhardt, 1989). The advantage of using multiple sources of evidence is having the opportunity to triangulate the gathered information (Yin, 2009).

In terms of structure, this study begins with a literature review section. In this section, we present the internationalisation model adopted by the studied firm and the BG concept used in this study. Additionally, we characte-rise the relationship between MACS and the IP. In a subsequent section, we present an empirical study and the results are analysed and discussed. Finally, we present the conclusions, limitations, and some suggested lines for future research.

2. Literature review

2.1. Internationalisation models and BG firms

IP is usually associated with normal growth (Roque, Alves, & Raposo, 2019a) and is almost immediate in sectors of the economy heavily connected to research & development and to technology. Firms in the technological sector, usually named international new ventures, born-globals and global start-ups, appeared in the present globalisation era (Liesch et al., 2007); they follow the BGIM and undertake international business from an early stage in their development, often from the moment of legal incorporation (Gabrielsson & Kirpalani, 2004). Although markets react positively (Gleason & Wiggenhorn, 2007), this early and rapid internationalisation process poses new challenges in terms of limited resources (Bembom & Schwens, 2018). However, some researchers suggest that “resource scarcity can be a driver of, rather than an impediment to, early and rapid internationalization” (Keupp & Gassmann, 2009, p.616 ). These conflicting views still exist today.

In the literature, the two dominant models are the “U-Model” (Johanson & Wiedersheim-Paul, 1975; Johanson & Vahlne, 1977), in which internationalisation is presented stepwise and incrementally, and the “I-Model” (Bilkey & Tesar, 1977; Cavusgil, 1980; Reid, 1981; Czinkota, 1982; Andersen, 1993), which perceives internationalisation as an innovation process. However, some authors have highlighted other models such as the BGIM (Knight & Cavusgil, 1996; Bell, 1995). The incremental IP of older multinationals contrasts with the early, rapid IP of BG firms and research is needed “to explain how BGs achieve precocious internationalization and superior international performance” (Knight & Liesch, 2016, p.98).

BGs’ expansion is due to the growth of information and communication technology and to globalisation (Knight & Cavusgil, 2004). Technological progress allows internationalised firms to significantly reduce their transaction costs. Hence, technological evolution improves and facilitates internationalisation, removing barriers (Madsen & Servais, 1997), and this evolution contributes to a shorter products life cycle, allowing small firms to rapidly respond to changes in consumer behaviour (Rennie, 1993). According to Bell, Mcnaughton, Young & Crick (2003), BGs are firms that can be classified as “knowledge-intensive firms” (p.349), using new technologies and scientific knowledge to enhance competitive advantage; and as “knowledge-based firms” (p.349), creating new technologies, which will become the basis for product and service development.

BG strategy requires an early adjustment of the organisational structure to an increasingly global market, allowing the firm to obtain cross-market information for a good needs’ diagnosis and to assist the decision-making process (Dimitratos, Jonson, Slow, & Young, 2003), leading to superior performance.

There is no universal consensus on the precise definition of “born-global” and many researchers use divergent criteria to operationalise the BG concept (Dzikowski, 2018; Rasmussen & Madsen, 2002; Rialp-Criado, Rialp-Criado, & Knight, 2002). Coviello (2015, p.21) argues that “many so-called BG studies are, in all likelihood, not”.

Moen & Servais (2002) argue that BGs are small, technologically oriented firms, operating in international markets from inception, developing their IP in an accelerated way, with sales to foreign markets reaching 25% of the total in the first three years of the company’s life (Bell et al., 2003). For others, BGs are firms that simultaneously adopt a vision and strategy to become international practically from the date of their creation (Bell, 1995; Gabrielsson & Kirpalani, 2004; Knight & Cavusgil, 1996, 2004; Oviatt & McDougall, 1994; Rialp, Rialp, & Knight, 2005a; Rialp, Rialp, Urbano, & Vaillant, 2005b), seeking to obtain significant competitive advantages derived from resource usage and output sales in several countries (Oviatt & McDougall, 1994). Accordingly, the success of this type of firm necessarily lies in a global vision. Firms must “think globally” to become global (Persinger, Civi, & Vostina, 2007).

The literature emphasises some specific features of BG firms (Liesch et al., 2007). Hence, SMEs that internationalise are usually successful examples; some firms challenge conventional internationalisation theories, since they internationalise directly and with highly innovative products, outlining the internal market, and they contradict the myth that small firms’ strategic options are limited by resource scarcity.

BGs’ early and rapid internationalisation has drawn the attention of numerous authors (Andersson, 2000; Andersson & Wictor, 2003; Cavusgil & Knight, 2015; Chetty & Campbell- Hunt, 2003; Crick & Jones, 2000; Coviello, 2015; Etemad, 2004; Freeman & Cavusgil, 2007; Gabrielson & Kirpalani, 2004; Madsen & Servais, 1997; McAuley, 1999; Oviatt & McDougall, 1994; Persinger et al., 2007; Thanh & Chong, 2008), who explain these firms’ success through variables such as entrepreneurial personalities, the competitive environment, contact networks, resources and organisational structure.

However, a rapid IP can bring challenges. Braunerhjelm and Halldin (2019) conclude that BGs’ future perspectives depend on their ability to cope with the costs and risks derived from rapid internationalisation. This “coping ability” is supported by MACS.

The literature on BGs shows two distinct research strands (Gassmann & Keupp, 2007). In the first, internationalisation patterns are analysed over time (Knight & Cavusgil, 2004). In the second, we find studies that analyse internal factors, such as managers’ personal traits or organizational characteristics (Jones & Coviello, 2005, Knight & Cavusgil, 1996, Kundu & Katz, 2003, Moen, 2002, Rialp et al., 2005b). However, few studies focus on firms’ organisational features from the structural point of view, based on the competitive advantage that allows them to internationalise. Therefore, this paper intends to fill this gap, ascertaining how organisational structure, namely MACS, is affected and in turn affects the IP.

2.2. Management accounting and control systems and internationalisation strategy

MACS can be used to maintain or modify models or standards in organisational activities and also to implement strategies (Anthony & Govindarajan, 2007; Henri, 2006). MACS design should be specific to a firm, respecting its organisational structure (Gomes & Salas, 2001). MACS use management accounting information to achieve goals (Chenhall, 2003) and simultaneously include control mechanisms of various types (Malmi & Brown, 2008, Strauss & Zecher, 2013). MACS are therefore fundamental to providing managers with the information that allows them to evaluate strategy implementation, to assist in the decision-making process (Soobaroyen & Poorundersing, 2008; Hammad, Jusoh, & Ghozali, 2013) and to implement the necessary adjustments to achieve organisational goals (Gomez-Conde, Lopez-Valeiras, Ripoll-Feliú, & Gonzalez-Sanches, 2013).

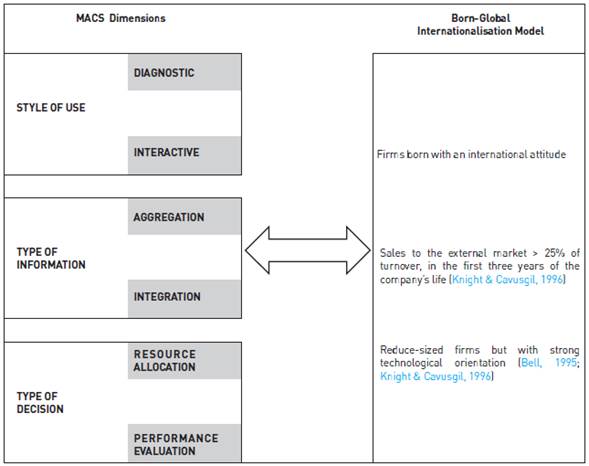

As the literature has developed, different MACS classifications have emerged with a distinction being made between financial and non-financial control, formal and informal controls, action controls and result controls, and more and/or less rigid controls (Tsamenyi, Sahadev, & Qian, 2011). In this study, MACS is operationalized as a multidimensional concept with six dimensions grouped into three categories (Novas, Alves, & Sousa , 2017) as shown in table 1.

Table 1 MACS Classification

| MACS categories | Meaning | Dimensions |

|---|---|---|

| Style of use | Style of use of information provided by MACS | Diagnostic Interactive |

| Type of information | Type of information provided by MACS | Aggregation Integration |

| Type of decision | Type of decision supported by MACS | Resource Allocation Performance Evaluation |

Source: own elaboration.

Systems in which the style of use of information is “diagnostic” correspond to formal information systems used by managers to control outcomes and to correct performance deviations, thus being limited systems in terms of searching for innovative solutions and identifying opportunities (Simons, 1995). These systems match management control’s traditional definition (Simons, 1991). On the other hand, “interactive” systems promote innovation, learning and the search for new solutions. They stimulate new strategies as managers interact with emerging opportunities and threats (Novas et al., 2017). Control focuses on communication and cooperation, which allows information to flow and foster debate and dialogue, creating and integrating knowledge (Agbejule, 2006). The distinction between an interactive and diagnostic usage of information and control mechanisms was initially presented by Simon (1995) and aimed to distinguish firms’ management control systems.

Regarding the type of information provided by MACS, aggregated information favours management of decentra-lised units, allows a large volume of information to be processed over a given time period and enables managers to compare more alternatives and gain a better understanding of the relationships established among different organisatio-nal units (Bouwens & Abernethy, 2000). On the other hand, integrated information enables the understanding of cause-effect relationships between the operational structure, strategy, goals, and financial results (Chenhall, 2005). It even provides coordination mechanisms among different organisational units, thus being fundamental in decentralised structures in terms of the decision-making process and control (Chia, 1995). Hence, firms with more aggregated and integrated information have more sophisticated MACS.

Concerning the type of decision supported by MACS, “resource allocation” and “performance evaluation” decisions are considered. Resource allocation corresponds to a MACS usage for planning and coordination purposes (Novas et al., 2017) and is defined as the distribution of monetary and non-monetary resources over different decentralised units, in order to allow managers to perform their activities (Naranjo-Gil & Hartmann, 2006). All information is focused on resource distribution and, in situations of uncertainty, better information will obviously result in better resource usage (Baines & Langfield-Smith, 2003).

In “performance evaluation” decisions, the system focuses essentially on how performance can be improved (Novas et al., 2017), using information for monitoring and controlling organisational goals (Naranjo-Gil & Hartmann, 2006; Reck, 2001; Reed, 1986), as well as for organisational units and managers’ performance control (Silvi, 2012).

MACS dimensions are usually considered in isolation, however in some cases there may be some overlap. Therefore, the relevance of a given dimension or a particular dimensions’ configuration, at a given moment, might result from a particular context (Bouwens & Abernethy, 2000; Bedford & Sandelin, 2015) or even from the stage in the organisation’s lifecycle (Moores & Yuen, 2001). A given MACS structure may work in one organisational context and not in another (Saulpic & Zarlowski, 2014). Therefore, different MACS configurations and usages have different consequences for the firm (Otley, 2016).

Little is known about MACS’ effects on strategy implementation (Frigotto et al., 2013). It is assumed that the development of the internationalisation strategy is supported by a MACS that provides suitable information to relieve management difficulties. The model is fundamentally supported by a MACS that enables a diagnostic and/or interactive information flow, furthers the decision-making process (Simons, 1991) and creates a system of good practices to stabilise and diffuse the organisation’s capacities (Novas et al., 2017).

A diagnostic MACS is a more formal control system (Simons, 1995), where there is little intervention from those responsible (Simons, 1991). These are more autonomous systems which do not stimulate neither debate nor dialogue (Simons, 1990; Vaivio, 2004). The critical success factors are simply defined and the concern is simply to implement previously deliberated strategy (Pešalj, Pavlov, & Micheli, 2018). In turn, an interactive MACS is less restricted and more informally controlled. It provides the BGIM with information that promotes dialogue, knowledge creation and integration that supports export development and stimulates innovation (Novas et al., 2017; Agbejule, 2006). With this MACS managers and employees can identify uncertainties and/or strategic opportunities; they can therefore develop an alternative strategy and modify the existing management control, as well as performance tools (Pešalj et al., 2018).

Regarding the nature of MACS information, BGIM finds support in a system with more aggregated information that allows the processing of a large volume of information in a given period of time, which is very useful for decision-making purposes (Bouwens & Abernethy, 2000). As previously mentioned, BGs are firms with a strong technological orientation based on a large set of information (Bell, 1995; Knight & Cavusgil, 1996), hence there is a predisposition for information to become more aggregated over time.

Still, BGs also need integrated information to coordinate distinct units. This information becomes fundamentally relevant in decentralised structures for both decision-making and control (Chia, 1995). Integrated information permits an understanding of the causal relationships between operational structure and strategy (Chenhall, 2005).

Information is essential to managers’ decision-making, so BGs pursue systems which support resource allocation, performance evaluation and control decisions. In firms with a strong technological orientation such as BGs, it is simultaneously necessary to plan and coordinate resources, and to monitor organizational progress toward goal fulfilment.

3. Research model and methodology

To study the relationship between IP and MACS design and use, a single case study was developed in a Portuguese firm using a procedural and dynamic approach (Henri, 2006). To define MACS, three dimensions were considered (Novas et al., 2017): style of use of the information provided, type of information provided, and type of decision supported. We sought to relate each of these dimensions to the BGIM’s main characteristics. The proposed research model is presented in Figure 1.

The methodology’s selection depends on the phenomenon to be studied (Ryan, Scapens, & Theobald, 2002; Yin, 2009). This study used a qualitative research approach, through a single case study (Yin, 2009, 2014).

Qualitative research is recommended for analysing complex phenomena in areas where little prior knowledge is available (Strauss & Corbin, 1998), and the need to conduct qualitative studies has been recognised by various scholars (Ahrens & Chapman, 2006; Dzikowski, 2018). Qualitative research enables researchers to record information, perceive reactions to more complex questions, and analyse the participant’s speech, intentions, actions and interactions more intimately (Dana & Dunmez, 2015). Qualitative research goes further (Miles, Huberman, & Saldana, 2014), beyond pure induction and into contributions towards theoretical developments (Ketokivi & Choi, 2014).

The case study process (Yin, 2009) began with the planning stage, and a focus on identifying the research questions which are: (1) how did the company’s MACS facilitate (or not) the implementation of a Born-Global Internationalization Model (BGIM); and (2) how has the BGIM implementation involved (or not) changes in the MACS?

After the selection of the case study design, a case study protocol was developed (conducting a pilot case) and data from documents and personal in-depth interviews were collected and analysed (Yin, 2009). Critical incident technique (Flanagan, 1954; Hettlage & Steinlin, 2006; Hay, 2014) was used in our study, and allowed us to collect subjective information with reflexive logic, which derives from situations experienced by the interviewees (Chell, 2004).

4. Empirical study

This section begins with a presentation of the research context: the firm which was analysed and the key informants. Following this, the study results are presented and discussed.

4.1. Firm and key informants

Critical Software (CS) is a firm in the Information and Communication Technology sector dedicated to software production and commercialisation. CS develops computer engineering solutions that support critical systems, such as entrepreneurial and institutional information and business systems. Its core business is to create infallible software tools.

This is a firm that was born-global, and strategically created with the goal of responding to growing demand in an increasingly global and technological world.

In 1998, an academic paper, authored by the firm’s three founders and published in a scientific journal, caught NASA’s attention. The publication presented an advanced technology prototype of software verification and validation, called “Xception”. This software’s mission was to inject system failures, testing them to exhaustion, simulating random errors and searching for solutions. After the publication, the founders received an e-mail from NASA and, although still embryonic, CS became a supplier to one of the largest agencies in the world. The natural consequence of this was an active export process (Cavusgil & Knight, 2015; Coviello, 2015), and the opening of a subsidiary in San José, California, in less than a year.

Currently, CS is a multinational firm, with just over 800 employees working in outsourcing with software development firms scattered around the world. In 2018, its turnover reached €45m and the forecast for 2019 is €50m.

In Portugal, CS is headquartered in Coimbra with two additional branches in Lisbon and Oporto. It is represented in various parts of the world, through representatives, subsidiaries and partners. In Europe, it is present in Southampton (United Kingdom), Munich (Germany) and Bucharest (Romania). In the Americas, CS has representation in São José dos Campos (Brazil) and in California (USA). In Africa, it has a presence in Maputo (Mozambique) and Luanda (Angola).

CS’s mission is to ensure the correct functioning of organisations’ and firms’ key sectors. Its purpose is to avoid failures in “critical systems” that can endanger and irreparably damage an institution’s image and profitability.

“Critical Software enters the scene when failure is not an option. Whether in space, aeronautics or civil area, the Portuguese firm is experiencing an accelerated internationalisation, with a rampant turnover. And its eyes are on the future.”1

CS was selected for convenience and for having aroused great curiosity. It has been referenced in several national and international news outlets, considered one of the best 100 firms to work for in Portugal (EXAME magazine, 2017 Oct.), developed software for NASA (SOL Journal, March 19th 2018), and has noteworthy business volume (Jornal de Negócios, 10th April 2017).

Once the firm had been chosen, it was important to identify the key informants.

For this purpose, an email was sent to the communication office, explaining the study’s goals. In response, the information officer Dr Rita Pimentel indicated the key informants (Table 2) and specified that they were chosen for the knowledge they possess on IP and MACS, having followed them from the beginning through to the first steps in internationalization and the consequent international growth of the company.

Table 2 Key informant characteristics

| Interviewee name | Position of Interviewees | Date and interview length | Place | |

|---|---|---|---|---|

| Pedro Murtinho | E1 | Chief Financial Officer (CFO) Head of Partnerships & Alliances e Executive Management Team | March 2018 90 min | Corporate headquarters |

| Liliana Ladeiro | E2 | Corporate Financial Controller (CFC) | March 2018 95 min | Corporate headquarters |

Source: own elaboration.

This “interviewee self-selection” is part of a Snowball methodology suitable for this type of study (Biernacki & Waldorf, 1981).

Considering that the interviewees had been following the IP since the creation of the company, the objective was to have them recall the history of the IP, using critical incident technique (Flanagan, 1954; Hettlage & Steinlin, 2006; Hay, 2014).

4.2. Analysis of results

4.2.1. Critical software’s internationalisation process and adopted model

Over the years, CS’s strategy for high growth was to combine a market penetration strategy with high barriers to entry. As a result, the firm quickly excelled in the development of value-added software (the so-called “critical software”), thus removing itself from the competition (low-cost software industry in Asian countries).

In 2002, sales abroad (exports) exceeded domestic sales, a trend that has since remained over the years, with exports representing about 70% of the company’s results.

The strategy to create several subsidiary firms, as well as creating a set of spin-off firms, aimed at exploring new high-technology products and services, has increased and consolidated the IP. Contact with foreign markets is initiated by exports, then the process develops very quickly through opening subsidiaries.

“The entryways, as in any firm that begins this process, began by exporting “critical mass” and from there we quickly realized that the solution would be a much greater investment in the process and the creation of subsidiaries.” (E1)

The entire process was initially structured by the company’s CEO. Nevertheless, with exponential growth across borders, the responsibility delegation of the process has been shared with other elements responsible for diffe-rent markets. Presently, as in the past, the company’s CFO is the person who gathers and analyses the whole process and thus represented a key informant to answer our questions.

In order to develop the study and deepen knowledge about the IP, we asked the interviewees to comment on the motivation behind the IP’s origin. They stated: “Because of the US’ internal mandatory issues. That is, NASA was our first customer and the US required them to establish relationships with suppliers settled on American soil. That was the starting point. We have established ourselves to meet the needs of our main client.” (E1). “(The) Motivation was our core business. The services we have to offer forced internationalisation.” (E2)

“E1” added that the variables for the process development were essentially two: (1) a business which “captures” special customers, such as space agencies, and which force the firm to develop across borders; and (2) the desire to increase margins, a process that was encouraged by the establishment of partnerships (with the European Space Agency and other countries).

The interviewees also mentioned that in this process the market choice was clearly influenced by the existing relationship, by the market’s size and potential, by the contact with the partner and the opportunity to grow alongside important competitors, which is a positive variable that enhances development. On the other hand, territorial, linguistic and cultural proximity are less important variables, although the firm has a strong presence in Portuguese-speaking countries, namely Brazil, Angola and Mozambique.

When questioned about the process’ main difficulties, the interviewees referred to human resources qualifications and culture as the major obstacles to process development. Hence, we questioned whether they resort to the company’s employee mobility abroad to mitigate this difficulty. “E1” stated that: “Despite the difficulties in hiring and qualifying workers, we always hire local people. We look for references, but even so, the training ends up hampering the process. In Europe, we occasionally confirm the mobilization of some employees.”

The interviewees also emphasised political and fiscal variables as conditioning factors. Brazil had fiscal barriers, and Angola and Mozambique had political constraints.

Nevertheless, there are also opportunities in countries that should be explored: “Countries like Romania are attractive, there are tax incentives and no IRS is paid.” (E1)

In order to understand the relationships established across borders, we asked the interviewees about possible partnerships. “E1” said: “We have established a commercial partnership (with Player) because there are markets, such as Africa, where we cannot sell directly.”

With the unfolding of the interviews, we realized that geographical expansion is part of CS’s nature. Hence, and in order to understand the predictions for expansion, we questioned the interviewees about potential markets for future investments. Accordingly, future markets could be the United Kingdom, Germany and Scandinavia, as they have attractive conditions for development; namely culture, human resources, proximity to customers, and suppliers.

The results obtained confirm that the model adopted in the beginning of the IP by the firm is the BGIM. The firm was effectively born with an external orientation (Coviello, 2015; Cavusgil & Knight, 2015; Knight & Cavusgil, 2004; Rialp et al., 2005b), assuming an international position and following all the assumptions and prerequisites to be classified as such, namely the requisite sales volume in the first few years of business (Rennie, 1993), an investment in knowledge (technological investment) (Bell et al., 2003), the development of networks (partnerships) (Zhou, Wu, & Luo, 2007; Madsen & Servais, 1997) and the adoption of a certain organisational structure (Simões & Domiguinhos, 2001). Other BG characteristics were validated, such as belonging to a technological sector and initiating the IP towards geographically distant or culturally distinct countries.

In conclusion, CS is a company whose internationalization was detected and examined shortly after its creation, as suggested by Coviello (2015), therefore CS started its internationalization strategy as a Born-Global, a conclusion shared by Simões and Dominguinhos (2001).

4.2.2. The management accounting and control system

After characterising the model adopted immediately after the creation of the company, we asked the interviewees about the existence, importance and evolution of the relationship between the internationalization model and MACS. The respondents replied: “Yes, the impact was progressive, as the process evolved, the system was being improved, in order to answer our needs.” (E1). “The impact is recorded in an evolutionary and stable way, allowing the process analysis, according to the information provided by the system.” (E2)

In order to understand CS’s MACS design evolution, we asked the interviewees about the changes that occurred in the last decade.

“We use the A.K.A. Dynamics NAV system, which is an enterprise resources planning (ERP) software solution, which translates subsidiaries’ accounting information and enables a global information reporting structure with weekly periodicity for managers and a monthly periodicity to the management board.” (E1)

“E2” added that in parallel a Business Intelligence tool, named “Data Farol”, was built. This software allows the manager to perform control and measure the cost structure. The existence of new accounting and control software is considered by the interviewees to be a very important tool to assist management control.

“It is crucial having a real control over the whole group anywhere in the world, whether it is financial control, performance control, quality… a structure able to answer the daily management problems.” (E1)

“It is necessary to have tools that assist us in financial reading because budgets and transfer prices are a constant challenge, especially in internationalisation processes as dynamic as ours.” (E2)

Regarding management control techniques, CS adopted Activity Based Costing in the last decade, as well as the Balanced Scorecard, which is systematically reviewed every 3 years. Despite the control tools’ help, the whole process is somewhat complex.

“The firm is metanational, i.e. each department is a firm on a multinational scale, which increases the difficulties, especially in terms of communication. We must adapt to the different languages and culture of the host country. The departmentalisation is vertically structured.” (E1)

Therefore, and in order to evaluate and characterise the MACS regarding the usage style of the information provided (diagnostic and/or interactive), we asked the interviewees to identify how the implemented MACS provides information to managers. The interviewees considered the system very important to implement new ideas and ways of accomplishing tasks, as well as to discuss hypotheses and action plans. They claimed that the system allows them to align performance measures with strategic goals, establishing permanent coordination with subordinates and evaluating them adequately, since established project teams perform the individual evaluation on a quarterly basis.

Nevertheless, they ascribe only some importance to the ability of the system to assist in the identification of strategic key areas, as well as establishing and negotiating medium and long-term goals and objectives while still functioning as a learning tool.

Regarding the type of information provided (aggregated and/or integrated), both interviewees consider information that enables them to determine costs and other measures related to the various departments as extremely important; including integrated information related to fixed and variable costs, sectoral information related to specific areas (departments, cost centres), namely of each task, operation or function (time controls), consolidated information and information by sector.

Considering the third MACS dimension (Novas et al., 2017), we asked the interviewees to comment on the type of deci-sion supported by MACS, regarding financial and non-financial resource allocation (e.g. materials, human resources, time), as well as decisions related to the monitoring and control of goal and objective fulfilment by the units or services under supervision. Concerning decision-making, the interviewees classify MACS as highly important, as well as all the financial information, quantitative information, non-financial information and the qualitative information reported by the system. “E2” also emphasised the high relevance of the formal information system, whose outputs (reports) are received periodically from each branch.

Finally, we asked the interviewees to evaluate the relationship between the MACS and the IP.

“Almost all the IP decisions depend on MACS results.” (E1)

“The system is directly related to the IP and it influences the internationalisation’s structure. There is a MACS impact on the decisions that are made for the branches at every level. Everything is evaluated and the IP depends on the assessment that is made.” (E2)

Regarding the MACS structure, we confirmed that the system’s dimensions follow the assumptions of Novas et al. (2017) and Simons (1991).

4.2.3. Relationship between the management accounting and control system and the internationalisation model

On the one hand, from the historical review and the IP analysis performed, it can be concluded that the model adopted by CS immediately after the creation of the company is the BGIM, as we could see in section 4.2.1. On the other hand, considering the analysis of the MACS we consider that this is an important provider of information essential to assisting in the decision-making process. In table 3, we present the results of this study on the relationship between CS MACS and the initial IM adopted (BGIM).

Table 3 Relationships between the MACS and the IP characteristics

| IP characteristics | MACS Dimensions | Results | |

|---|---|---|---|

| Firms born with an international attitude | Utilization | Diagnostic | The diagnostic use of information is “marginalised” in this type of firm, since it is more superficial, less dynamic and with little involvement (Simons, 1990; Vaivio, 2004). From the answers provided we conclude that since the beginning of the IP there is a large amount of direct intervention from the whole team (managers and subordinates). Everything is shared and the coordination of tasks is interactive. |

| Interactive | A complete system in which information usage is mostly interactive, because the system promotes innovation and learning, and stimulates new strategies as managers interact with emerging opportunities and threats (Novas et al., 2017). Control focuses on communication and cooperation (Agbejule, 2006). To that end, it is recalled that CS has built a business intelligence tool: Data Farol. | ||

| Sales to the external market > 25% of turnover, in the first three years of the company’s life (Knight and Cavusgil, 1996) | Information | Aggregation | Aggregated information allows the firm to process information for the various domains of business reality (Bouwens & Abernethy, 2000). Since CS is a firm with a strong technological orientation supporting itself with large datasets to support expansion through BGIM, there is a propensity for information to be more aggregated, thereby facilitating the management of decentralised units. |

| Integration | CS shows considerable involvement, promotes innovation and learning, and seeks new solutions (Novas et al., 2017). It builds knowledge and information integration mechanisms (Agbejule, 2006). Therefore, it is a firm that relies on a MACS that reports mostly integrated information since there is the need to coordinate different units, to make decisions and also to control each branch (Chia, 1995). | ||

| Reduce-sized firms but with strong technological orientation (Bell, 1995; Knight and Cavusgil, 1996) | Decision Type | Resource Allocation | CS relies on a system that supports resource allocation decisions. The MACS is used for planning and coordination purposes (Novas et al., 2017) and controls the distribution of monetary and non-monetary resources across decentralised units. In the BGIM, MACS assumes a very complete system of tangible control. |

| Performance Evaluation | CS relies on a system which helps evaluate performance. The MACS used information for monitoring and controlling organisational goals (Naranjo Gil & Hartmann, 2006; Reck, 2001; Reed, 1986) and organizational units and managers’ performance control (Silvi, 2012) MACS is also a very complete system of intangible control. |

Source: own elaboration.

5. Conclusions

In this study, we have shown that with the BGIM, advan-ces in information technology and globalisation facilitate knowledge acquisition and the evolution of the IP (Chetty & Campbell-Hunt, 2004; Madsen & Servais, 1997).

The firm studied has developed its IP since inception. At a few months old, CS opened its first international branch. In addition, it developed immediate contact with international markets through exports and quickly expanded its network by opening more branches. This entire path has corresponded to the BGIM (Bell, 1995; Gabrielsson & Kirpalani, 2004; Knight & Cavusgil, 1996, 2004; Oviatt & McDougall, 1994; Rialp, Rialp, & Knight, 2005a; Rialp, Rialp, Urbano, & Vaillant, 2005b).

After our analysis of the relationship between MACS and the BGIM, we conclude that the firm uses MACS according to its information needs. The IP develops and systematically requires new information from MACS. In turn, MACS follows this evolution, progressively adapting to the IP’s needs. We therefore verify changes in the MACS’ design, namely in the characteristics of the available information (MACS’ passive role) and in terms of the way the information is used (MACS’ active role), during the IP. Thus, in this process, the style of information usage is mostly an interactive style (Novas et al., 2017) which enables information sharing between all branches and the organization, stimulates innovation (Novas et al., 2017; Agbejule, 2006) and contributes to determining costs and developing performance assessment tools (Pešalj et al., 2018).

Regarding the character of the information in question, it can be aggregated and/or integrated as the system makes it possible to process a large amount of information, essential to understanding the relationship between different organizational units (Bouwens & Abernethy, 2000) and performance in the IP.

At the same time, information integration allows a causal correlation between operational structure and strategy by setting objectives and financial results (Chenhall, 2005), since it allows the firm to collect fixed and variable cost information, and specific information about certain areas, tasks, and sectors.

The type of decision can support resource allocation and performance evaluation decisions. The information coming from the MACS assists the decision-making process, both for resource allocation and performance evaluation (Novas et al., 2017). It also indicates the best way to use resources (Baines & Langfield-Smith, 2003), and to monitor and control objectives (Naranjo-Gil & Hartmann, 2006; Reck, 2001; Reeds, 1986). To this end, CS receives and periodically analyses MACS reports, where it provides financial and non-financial information about the entire organization and its subsidiaries.

We conclude that the firm has a strong entrepreneurial orientation and, through MACS, it attains the information needed to foster innovation and develop knowledge, in order to achieve success in international markets. The MACS is tailored to the firm’s information needs and facilitates the implementation of the internationalisation strategy. However, this process involves adjustments to the MACS.

Recalling our research questions, we ascertain that the company’s MACS facilitates the internationalisation strategy’s implementation and development; (1) as it collects crucial information for the IP, and cumulatively the adopted model implies changes in the MACS; (2) in adopting and adapting accounting and control tools which support the IP.

In terms of contributions, this study provides evidence for the existence of MACS’ diverse roles (passive and active) in the BGIM, in agreement with other recent studies (Naranjo-Gil, 2016; Coller, Frigoto, & Costa, 2018). It also emphasises that MACS are used throughout the BGIM in a differentiated way, according to informational needs, and it highlights the importance of a dynamic and well-structured system that helps firms with technologically challenging characteristics such as these. There is no study comparing both MACS and BGIM in a single case study. Thus, the present study fills this gap in the literature. Finally, this work also contributes to reinforcing contingency theory-based research results, since there is a MACS’ adaptation (Grabner & Moers, 2013; Otley, 2016) to the IP’s contingent factors (Ginsberg & Venkatraman, 1985).

However, some limitations are assumed to exist in the present study, mainly as the analysis is limited to a single case study, which means that we cannot generalise from our conclusions. Nevertheless, we sought to increase the robustness of our conclusions by interviewing several key informants. This limitation might be overcome by performing further case studies, which would enable us to perform a comparative analysis at a later date.